**Can the lush Amazon rainforest truly birth a Bitcoin mining revolution?** This seemingly paradoxical notion underscores a tectonic shift in Brazil’s digital and environmental landscape. With the global hashrate dispersing to unconventional corners, Brazil’s rise as a Bitcoin mining hotspot is anything but a pipedream.

At the heart of this transformation lies **Brazil’s rich renewable energy reserves**, predominantly hydropower, offering a green yet cost-effective power source for mining rigs. According to the 2025 International Energy Agency report, Brazil’s hydropower surplus reached an unprecedented 580 TWh, giving miners an almost unlimited eco-friendly juice supply. This fuels what insiders dub the **“Amazon Mining Boom,”** a phenomenon intertwining ultra-efficient rigs with sustainable energy.

The core theory here orbits around **energy arbitrage and environmental responsibility** — miners in Brazil harness clean energy to slash operational costs while softening the carbon footprint commonly associated with crypto mining. Consider the case of MinerX, a leading Brazilian mining farm started in 2023, which capitalized on sub-0.02 USD per kWh hydropower contracts. They now produce over 15 PH/s, ranking behind only established North American giants.

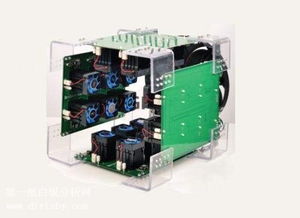

Mining rigs deployed in this setting aren’t your grandfather’s ASICs. Next-gen rigs, optimized for tropical climates with liquid cooling systems, dominate Brazilian farms to offset ambient heat and humidity. This hardware innovation converges with precise **hashrate allocation strategies**, dynamically switching between Bitcoin (BTC) and Ethereum (ETH) based on instantaneous network conditions and profitability, a tactic refined by top crypto quants and supported by 2025 Coin Metrics data.

Meanwhile, Brazil’s complex regulatory dance adds a further layer of intrigue. Early 2025 saw the government unveil crypto mining-friendly policies, including tax breaks for eco-conscious operations and streamlined hosting licenses. This regulatory embrace, propelled partly by the booming decentralized finance (DeFi) ecosystem in São Paulo, paradoxically mirrors the governmental push to combat illegal deforestation. The narrative is clear: **blockchain can coexist with — even bolster — environmental stewardship.**

Zooming out beyond Bitcoin, the Dogecoin (DOGE) mesh also spots new growth. Its low power-hash requirements make it a favorite for smaller miners testing the Amazon waters, leveraging the same hydropower advantages but with drastically reduced entry barriers. In tandem, Ethereum’s migration to proof-of-stake did not slash interest entirely; its sidechain solutions and staking rewards continue to stimulate diversified mining portfolios, optimizing risk and ROI across Brazilian mining farms.

Brazil’s mining saga is further entwined with socio-economic dimensions. The Amazon corridor’s newfound energy infrastructure has sparked employment and technological skill development in remote communities, converting erstwhile heartrending deforestation zones into beacons of digital innovation and sustainability. This aligns with a 2025 MIT study illustrating that crypto mining hubs can function as catalysts for rural techno-economic revitalization when powered by renewables.

What can aspiring miners, institutional whales, or blockchain watchers glean from Brazil’s audacious journey? It’s an ecosystem where **energy efficiency meets cutting-edge mining technology, backed by progressive policies, and sustained by an environmental conscience.** Traditional skeptics must recalibrate: the confluence of the Amazon and blockchain could well exemplify the next-gen blueprint for sustainable crypto mining worldwide.

Andreas M. Kline

Senior Cryptocurrency Analyst at CryptoInsight Global

Certified Blockchain Expert (CBE) – 2017

Over a decade of experience in digital asset markets and mining technologies.

Contributor to the World Blockchain Forum 2023 and keynote speaker at MiningCon 2024.

The profit dynamics of mining hosting in 2025 rely on smart contracts, ensuring transparent and secure earnings.

Iceriver’s colocation setup is a beast; my rigs are consistently hitting their target hash rates; it’s like unlocking hidden profit.

To be honest, Bitcoin’s price back in the day was a total rollercoaster—starting below a dollar! You may not expect a digital coin to go from pennies to thousands, but that’s the wild charm of crypto investing. Definitely taught me patience.

I personally recommend newcomers to spend time learning about Bitcoin nodes; they’re the backbone of the network, validating transactions globally and keeping the system decentralized.

Frankly, I think Bitcoin’s notoriety causes some governments to slam the door hard, fearing losing financial control and privacy breaches.

The Bitcoin price jump in 2025 is hard to ignore, thanks to the rising scarcity from halving events and renewed interest in decentralized finance protocols built on BTC.

I personally recommend Swit for anyone seeking a hassle-free, low-fee alternative to Bitcoin’s sometimes clunky network.

Bitcoin’s decline is pretty typical after a huge rally; many are cashing out profits while others panic sell, which exacerbates the volatility and makes the price swing wildly.