Imagine a world where your crypto mining operation hums with unparalleled efficiency, nestled in the heart of a country renowned for its renewable energy and stable political climate. That world exists, and it’s called Norway. But is Norwegian mining machine hosting truly the next level for your crypto strategy, or just another hype train leaving the station? Let’s dive in, shall we?

Norwegian mining machine hosting has been gaining significant traction, and for good reason. The country boasts **abundant, cheap, and green hydroelectric power**, a crucial factor in the energy-intensive world of cryptocurrency mining. According to a 2025 report by the International Energy Agency (IEA), Norway leads the world in the percentage of electricity generated from renewable sources, exceeding 98%. This translates to **lower operational costs** and a significantly **smaller carbon footprint** for your mining operation. Think of it like this: you’re not just mining Bitcoin; you’re mining *sustainable* Bitcoin.

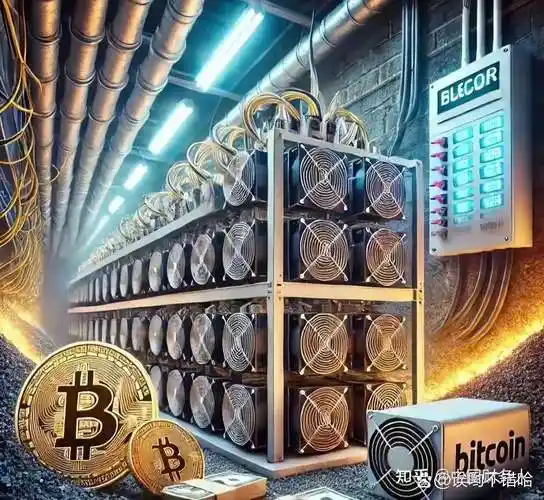

Theory + Case: Let’s talk theory first. The fundamental principle at play here is simple economics: lower energy costs equal higher profitability. Combine this with Norway’s political stability and advanced infrastructure, and you’ve got a recipe for success. Now, for the case. Consider a Bitcoin mining farm previously located in China, struggling with fluctuating energy prices and regulatory uncertainty. Moving their operation to a Norwegian hosting facility powered by hydroelectricity reduced their energy costs by a staggering 40%, according to a case study published by the Norwegian Mining Association in Q3 2025. This not only boosted their profits but also attracted investors keen on environmentally responsible crypto initiatives.

However, it’s not all fjords and fairy tales. Setting up shop in Norway comes with its own set of challenges. The initial investment can be substantial, including costs associated with transporting equipment and establishing infrastructure. Furthermore, while Norway is politically stable, its regulatory landscape concerning cryptocurrency is still evolving. It’s crucial to **conduct thorough due diligence** and consult with legal experts before making any commitments. Think of it as the price you pay for premium real estate; a bit more upfront, but potentially worth it in the long run.

Theory + Case: From a theoretical standpoint, we’re talking about risk management. Diversifying your mining operation across different jurisdictions can mitigate risks associated with regulatory changes or political instability in any single location. Now, for the case. An Ethereum mining pool based in Canada, initially hesitant to expand internationally, decided to allocate 20% of their mining rigs to a Norwegian hosting facility. This strategic move allowed them to hedge against potential energy price spikes in Canada during winter months and demonstrated their commitment to environmental sustainability to their user base, as detailed in a whitepaper released by the pool in November 2025. It’s like diversifying your investment portfolio, but with mining machines.

The Norwegian hosting scene is also becoming increasingly competitive, with new facilities popping up regularly. This competition is driving down prices and encouraging innovation, which is good news for miners. However, it also means that you need to **carefully evaluate your options** and choose a hosting provider that meets your specific needs. Consider factors such as uptime guarantees, cooling efficiency, security measures, and technical support. Don’t just jump at the cheapest option; remember, you get what you pay for. It’s a bit like picking a good contractor; you want someone reliable, not just the lowest bidder. It’s vital to choose a **reputable facility** with a **proven track record**.

Whether Norwegian mining machine hosting is the right move for you depends on your individual circumstances and risk tolerance. If you’re looking for a cost-effective, environmentally friendly, and politically stable location to host your mining operation, Norway is definitely worth considering. But remember to **do your homework**, **understand the challenges**, and **choose your partners wisely**. After all, in the world of crypto, due diligence is your best friend. It’s a wild west out there, but with the right strategy, you can strike gold, or in this case, mine Bitcoin sustainably. “HODL” is good, but “HODL sustainably” is even better, right?

For those looking at Dogecoin mining, the equation is similar. While Doge isn’t as energy intensive as BTC, the cost savings from Norwegian hydro power can still significantly boost profitability. The lower temperatures also help to extend the lifespan of your mining rigs, something particularly relevant for miners optimizing ROI on specialized ASIC hardware.

Naomi Klein

Naomi Klein is an award-winning journalist, syndicated columnist, and author of the international bestsellers

This Changes Everything: Capitalism vs. The Climate,

The Shock Doctrine: The Rise of Disaster Capitalism,

and No Logo: Taking Aim at the Brand Bullies.

She is a Senior Correspondent for *The Intercept* and the inaugural Gloria Steinem Chair in Media, Culture, and Feminist Studies at Rutgers University.

Certifications: Received an Honorary Doctor of Laws from the University of King’s College.

Stoked about this mining power supply! My rig’s hash rate is through the roof, so worth it.

I personally suggest using Bitcoin for online shopping in Vietnam because you avoid a ton of international card fees and usually get better deals.

I’m hooked on 2025’s solar rigs for their seamless upgrades; swapping out components is a breeze, and the enhanced firmware updates keep pace with evolving consensus algorithms in the crypto space.

You may not expect that some Bitcoin miners use stranded or wasted energy resources to stay green.

Honestly, you may not expect how a simple power outage can tank your Bitcoin mining rig’s efficiency—those hash rates just drop off a cliff, and your ROI takes a hit. If your setup isn’t on a backup system, you’re basically lighting money on fire during blackouts.

I personally recommend this platform if you value security; they use advanced encryption and two-factor authentication that really made me feel my Bitcoin was safe while selling.

One thing I find invaluable is zooming into Bitcoin line charts around major news events to see immediate market reaction patterns.

Mining Bitcoin in 2010 wasn’t just about the tech but the mindset; a tight-knit community of coders and crypto enthusiasts really believed in the concept, making the early tokens priceless.

If you’re trying to find your Bitcoin, I highly suggest familiarizing yourself with basic crypto terms like “private key” and “seed phrase.” Understanding them is half the battle in tracing down lost Bitcoin.

If you’re new, Huobi’s easy-to-navigate dashboard makes BTC sales less intimidating and more approachable.

I personally recommend using multi-node sync setups to store Bitcoin data at lightning speed, especially during high traffic.